Get the app

Why should you start using the app?

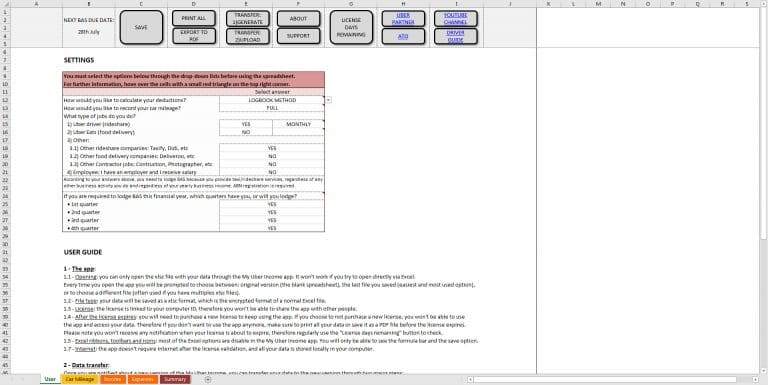

Being a rideshare & food delivery driver is also running a business. According to the ATO, all rideshare and food delivery drivers must register for GST, charge GST on the full fare, lodge business activity statements (BAS) and report the income in their tax returns.

Often new drivers struggle with the ins and outs of driving and running a business. Experienced drivers might find expensive and difficult to keep on top of their tax obligations.

That's when My Uber Income comes handy. Developed in 2016 and mastered along time, My Uber Income has been downloaded thousands of times and has an impressive positive feedback.

It gives you real time information about GST, tax, BAS, logbook, expenses, income and averages. It makes easier to lodge your BAS and tax return, and control your income and expenses.

The app is a result of:

Developed with the support of experienced drivers 95%

Vast taxation knowledge and how it applies to Uber 90%

Superior Excel and programming skills 100%

Business and data analysis skills 95%

Which will bring you the following benefits:

Plenty information to help you maximize profits 90%

Easy BAS and tax return, saving you a lot of time and hassle 100%

Compilation of all your data in an user friendly way 90%

Help to organise and plan your finances 95%

Worksheets

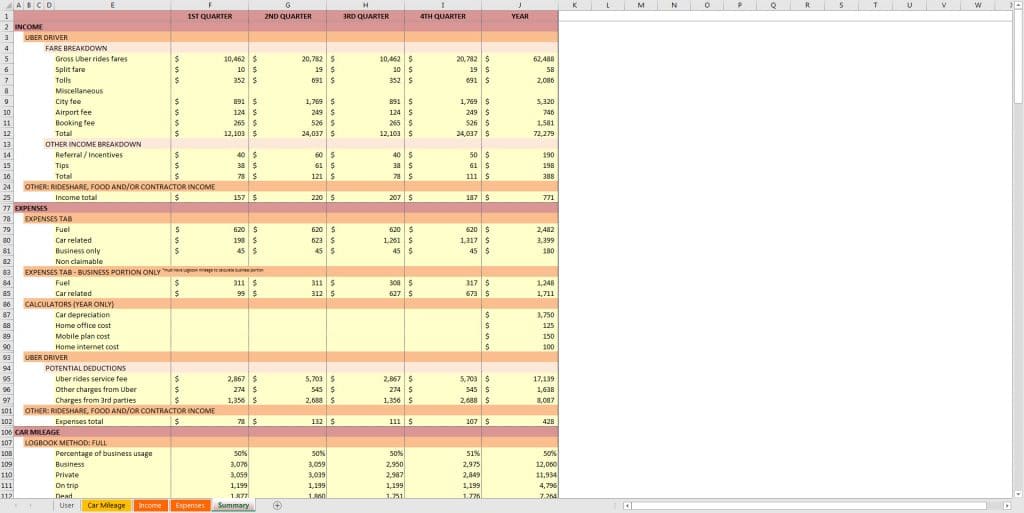

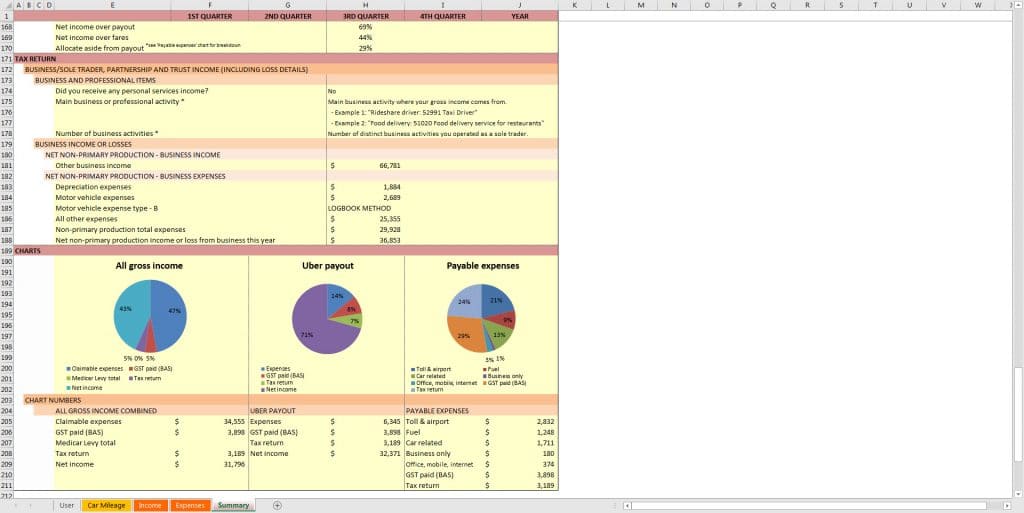

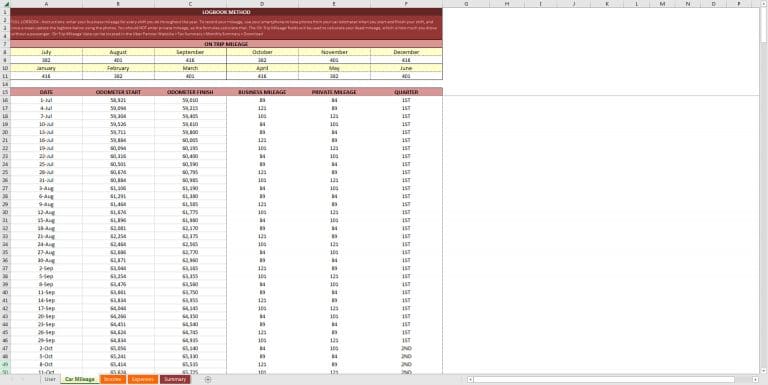

- Summary: in this tab you will find a summary and comprehensive analysis of your Ubering. All the data in this worksheet is calculated automatically based on the information entered in the other 3 tabs: income, expenses and car mileage

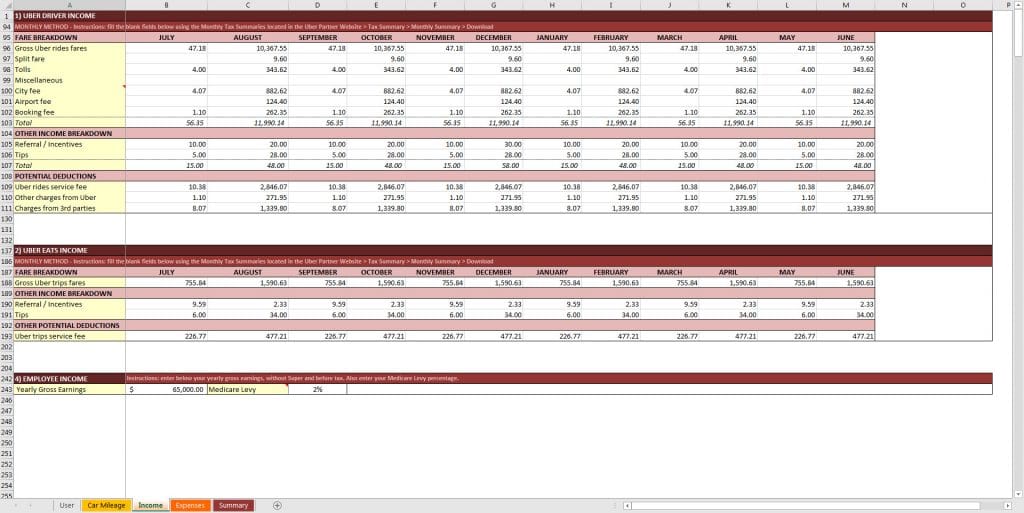

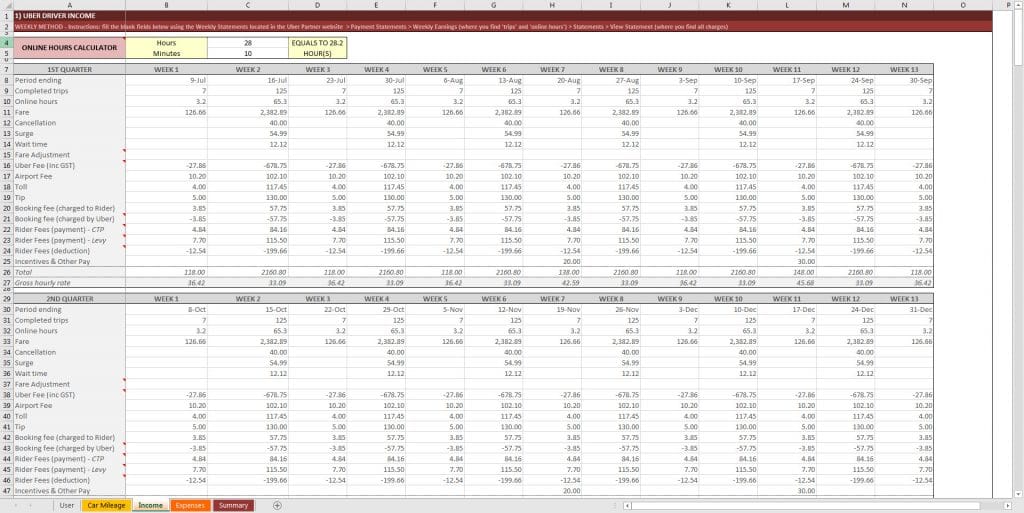

- Income: measured on weekly or monthly basis, you just need to copy your income information from the Uber website to the app

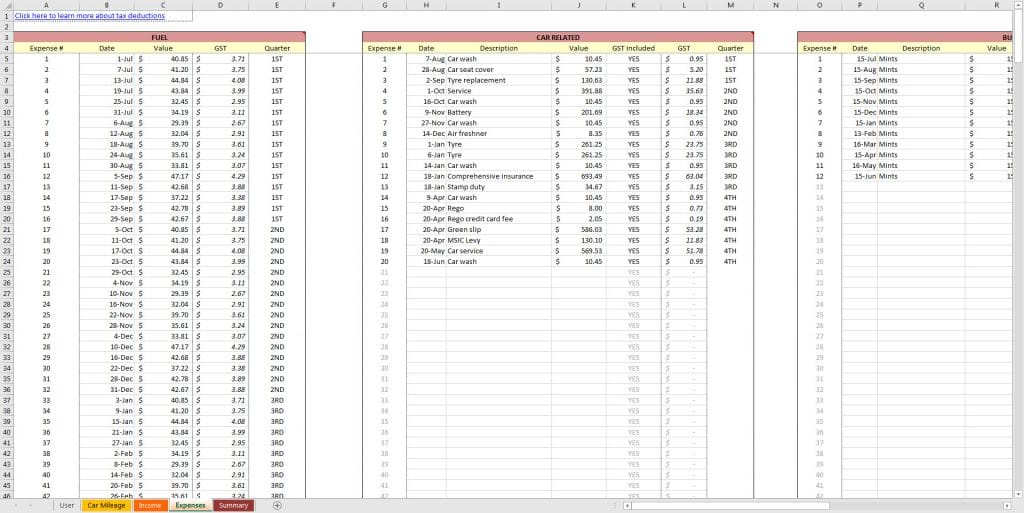

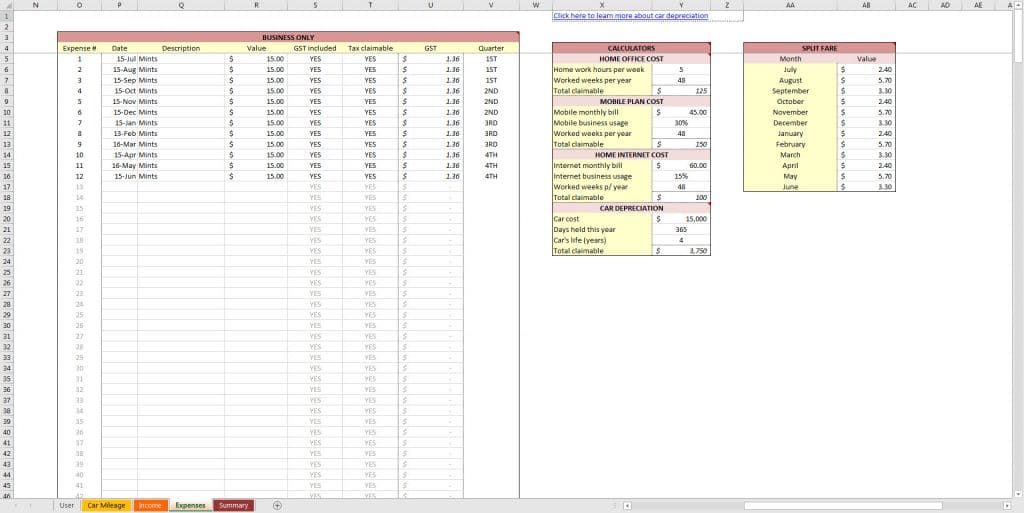

- Expenses: this is where you insert your expenses related to Uber

About My Uber Income